Social Networks as Marketplaces: How Social Commerce is Reshaping the Retail Landscape

In the era of digital transformation, the landscape of online shopping is swiftly evolving, with social commerce emerging as a revolutionary trend. Social commerce seamlessly integrates the convenience of e-commerce into social media platforms, enabling users to discover, engage with, and purchase products without leaving their favorite social media apps.

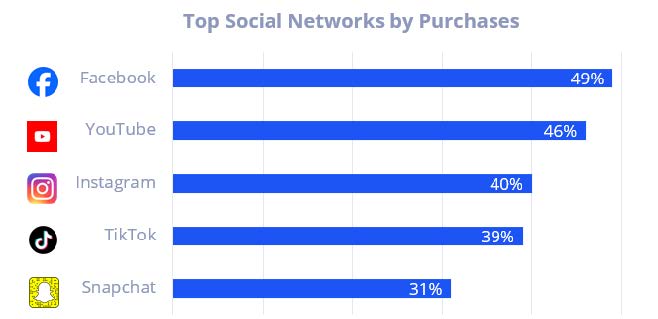

The rise of this innovative retail approach is linked to the global increase in social media usage, with consumers now shopping where they spend most of their time online. In 2023, sales through social networks accounted for an estimated 18.5% of total online sales and are set to grow to over an $8 billion USD industry by 2030. Gen Z and Millennial consumers are driving growth, with forecasters saying they will account for 62% of global social commerce spending by 2025. Product-wise, accessories, apparel, cosmetics, home décor, and consumer goods currently generate the most revenue for retail brands. Instagram leads the "big four" social commerce platforms with the highest average order value, reaching $65 USD per transaction, outpacing Facebook, Twitter, and Pinterest. Additionally, Facebook dominates in driving traffic to Shopify stores, accounting for two-thirds of all social media visits to these sites.

Source: Jungle Scout, “Consumer Trends Report: Q1 2023"

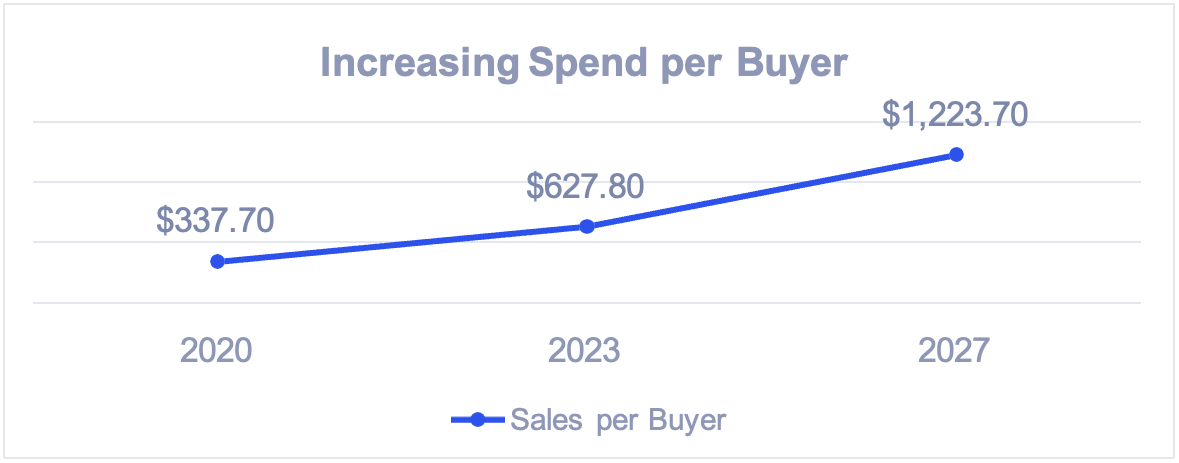

Social commerce is not just a trend, but a game-changer, opening new horizons for individuals and small businesses. A significant 59% of social commerce shoppers show a preference for purchasing from small businesses compared to traditional online shopping. Moreover, 44% are more likely to try a brand they haven't encountered before, indicating the potential for market expansion through these platforms. The anticipated doubling of spend per buyer from 2023 to 2027 is a testament to the continued growth of social shopping, which is driving most of the sales growth, rather than the acquisition of new buyers.

Source: Insider Intelligence | eMarketer Forecast, Oct 2023

Retailers are also getting behind social commerce, partnering with streaming platforms to have their products in front of new audiences. Examples include:

Anthropologie capitalized on social selling by launching a digital-only catalog, "AnthroLiving," on Pinterest in 2020, allowing users to interact with and purchase items, effectively catering to the platform's user behavior of extended decision-making and curation.

In 2021, Walmart hosted multiple shoppable livestream events across five social platforms. It became the first brand to partner with Twitter (now X) for live shopping, showcasing its innovative approach to blending retail and entertainment while meeting customers on their preferred platforms.

Ulta Beauty has demonstrated the effectiveness of AR (augmented reality) technology for beauty brands by leveraging Snapchat's upgraded AR shopping lenses, which facilitated virtual 'try-ons' and resulted in $6 million USD in sales and over 30 million product try-ons within just two weeks, offering personalized and immersive shopping experience that particularly appeals to younger, socially interactive consumers.

While social commerce is revolutionizing the retail sector, it has challenges. Data privacy is a significant concern, with nearly 40% of shoppers expressing wariness about making purchases through social media due to data handling concerns. This lack of trust poses a substantial barrier to wider adoption. Furthermore, younger consumers, particularly those aged 16 to 24, prefer established retailers over the in-app checkout options provided by social platforms. About three-quarters of these young shoppers choose the perceived security and reliability of traditional online retailers. These insights underscore the need for social platforms to enhance their data protection practices and build greater consumer trust to expand their appeal in the marketplace.

By 2025, it's projected that over 30% of all digital transactions will be fulfilled by a physical location, underscoring the critical role that brick-and-mortar stores play in the social commerce ecosystem. This integration enhances the value of commercial real estate, as physical stores not only serve as fulfillment centers but also create opportunities for experiential retail that drives both online and in-store engagement.

Nicole Larson, Manager, National Retail Research, Colliers

Nicole is responsible for studying conditions within the retail sector, collecting and reporting statistical data, and analyzing the data to identify significant trends and opportunities.

Connect on CREWbiz